03/10/ · For the majority of professional traders, the average Forex monthly return is between 1 to 10 per cent per month. Remember: you won't get anywhere near a return on your investment if you don't put sufficient efforts into educating yourself and learning how to utilise the different types of analytical and high quality trading tools that professional traders blogger.comted Reading Time: 6 mins 28/01/ · What is the average ROI on stocks or forex trading? In the trading industry, an annual ROI above 20% is an excellent return on investments. Yearly average day trading ROI is above 15% results in the forex and stock trading market. Return on Investment vs. Return of InvestmentEstimated Reading Time: 9 mins 06/06/ · blogger.com Forex Trading Return on Investment Speculators who trade currencies do so to make m

Forex return on investment

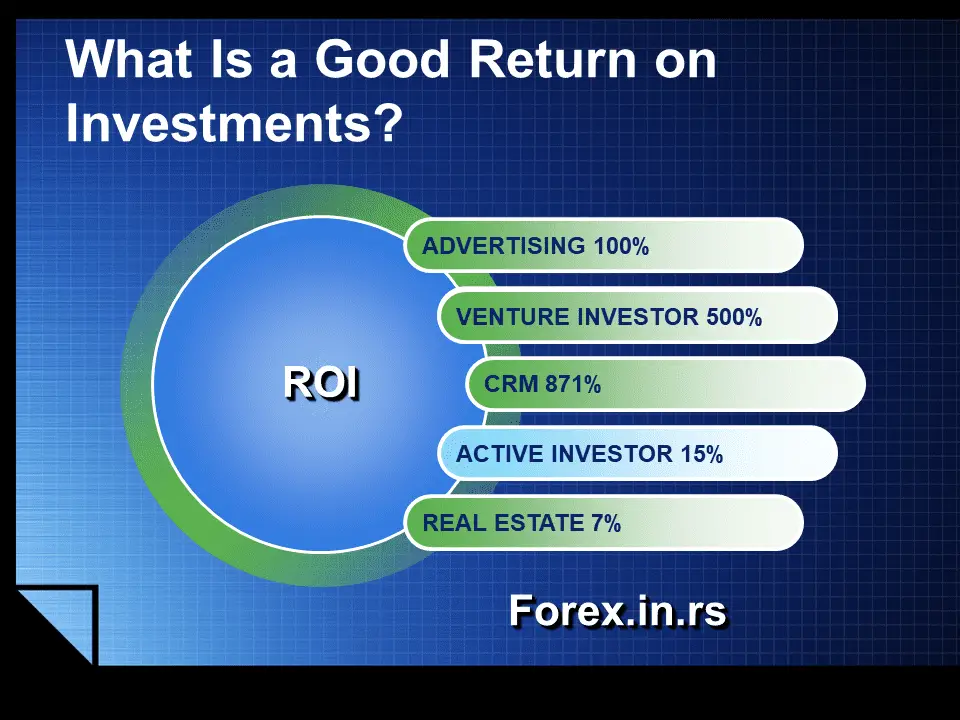

Acting in the financial market requires considering a variety of different key metrics. Return on investment ROI is one of them. It is widely used when a trader needs to measure the chances of gaining a fast and positive return from the investment.

In other words, the metrics make it possible to compare potential profit or loss based on the initial instrument cost. Another good thing about the metrics is the fact that it can be used either to measure the return in reference to a stand-alone or several investments. Besides, it helps to clarify the attractiveness of various investment alternatives, compare and contrast them, and finally choose the one with higher ROI perspectives. In this article, we will show how to make the necessary calculations and evaluate your possible return.

Before we learn how to calculate the ROI, we need to interpret the term making it easy for traders to understand how it actually works. Let's stress out two major issues of the metrics:.

A positive figure means when calculating ROI means that the net return is in the black. It means a potential profit, as the total return is very likely to exceed forex trading return on investment initial cost of the stock or another trading instrument. A negative figure means that the net return is in the red. In other words, it can be associated with a potential loss, as the initial cost is higher than the total return.

To make the calculations as accurate as possible, we need to take into account both total costs and returns. This is where a so-called apple-to-apple comparison can work when identifying the best option between two or more competitive investment alternatives.

Now when you know how to calculate your Return on Investment, forex trading return on investment, let's have a closer look at its possible advantages and disadvantages for the trader. On the one hand, forex trading return on investment metrics are simple to calculate and consider when choosing an ultimate instrument to trade or invest.

On the other hand, it is necessary to consider some other metrics such as timeframes, holding periods, etc. The first and foremost benefit is the fact that the metrics are pretty easy to calculate. We have already learned two major methods to handle the task, forex trading return on investment.

Besides, the metrics are not as hard to understand, as it may seem from the start, forex trading return on investment. It means that traders can use it as the general tool to measure the instrument's profitability. What's more, it is impossible to misunderstand ROI, as the calculations are very clear.

Despite all simplicity that comes with ROI calculations, traders may come across some stumbling blocks, especially in the long run. On the one hand, traders and investors have simple and easy-to-calculate metrics that help to define potential profitability. On the other hand, it comes with some limitations and aspects to take forex trading return on investment account.

It does not consider holding periods as well as it cannot adjust for the risk. Nevertheless, the Return on Investment is still the fundamental metrics that can be applied to figure out the investment rank as well as compare and contrast several investment alternatives. Although, it's not the only thing a trader should consider planning a strategy.

Read also about correct forex position sizing. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.

Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Tips to Calculate Return on Investment ROI Acting in the financial market requires considering a variety of different key metrics.

Explaining the Return on Investment Before we learn how to calculate the ROI, we need to interpret the term making it easy for traders to understand how it actually works, forex trading return on investment. Let's stress out two major issues of the metrics: First of all, ROI is generally expressed as the percentage but not a sum. It makes it easier for investors to understand what to expect in terms of return.

Secondly, when calculating ROI, you should also consider the net return in the numerator taking into account the return could be either negative or positive. What Does the Positive and Negative ROI Mean? Methods to Calculate ROI To calculate ROI, forex trading return on investment, you may opt for two different methods: ROI Pros and Cons Now when you know how to calculate your Return on Investment, let's have a closer look at its possible advantages and disadvantages for the trader.

ROI Advantages The first and foremost benefit is the fact that the metrics are pretty easy to calculate. ROI Disadvantages Despite all simplicity that comes with ROI calculations, traders may come across some stumbling blocks, especially in the long run. The metrics do not consider investment holding periods.

This fact may appear to be a challenge for traders who try to figure out the best trading alternative without knowing the particular timeframe.

It seems like option X is more appealing in terms of return, forex trading return on investment. However, ROI for investment Y can be generated over the years, which means stability and easiness to predict, forex trading return on investment ROI for investment Y has been generated only for the last few months. So, the timeframes are always to consider. Another problem is the inability forex trading return on investment the metrics to adjust for risks.

You need to clearly understand that ROI comes with a direct correlation with risk. If you look for the highest potential returns, the risks also increase drastically. It also means that the total outcome can be different as well. Last but not least, ROI refers to the category of profitability metrics. It only emphasizes financial profits and potential gains. The main disadvantage here is that it does not take into account ancillary benefits environment or social products.

For these types of goods, investors usually opt for Social ROI — a relatively new metrics. Final Word On the one hand, traders and investors have simple and easy-to-calculate metrics that help to define potential profitability.

Forex Trading for Beginners

, time: 8:39How FOREX Trades Are Taxed

30/06/ · When trading futures or options, investors are effectively taxed at the maximum long-term capital gains rate, or 20% (on 60% of the gains or losses) Nevertheless, the Return on Investment is still the fundamental metrics that can be applied to figure out the investment rank as well as compare and contrast several investment alternatives. Although, it's not the only thing a trader should consider planning a strategy. Read also about correct forex position sizing 03/10/ · For the majority of professional traders, the average Forex monthly return is between 1 to 10 per cent per month. Remember: you won't get anywhere near a return on your investment if you don't put sufficient efforts into educating yourself and learning how to utilise the different types of analytical and high quality trading tools that professional traders blogger.comted Reading Time: 6 mins

No comments:

Post a Comment