14/04/ · Using a reward to risk ratio, means you need to get 9 pips. Right off the bat, the odds are against you because you have to pay the spread. If your broker offered a 2 pip spread on EUR/USD, you’ll have to gain 11 pips instead, forcing you to take a difficult reward to risk ratio 13/05/ · Terminology Used. Forex traders refer to the risk/reward ratio as the r:r ratio, and the minimum condition, as described above, is This means that for every pip risked, there is 1 pip expected as a reward. The bigger the r:r ratio, the better for the overall money management system, but things should be kept in a realistic proportion 04/03/ · The risk-reward ratio or risk-return ratio in trading represents the expected return and risk of a given trade or trades based on entry position and close position. A good risk-reward ratio tends to be less than 1; that is, the return (reward) is greater than the blogger.comted Reading Time: 9 mins

Risk Reward Ratios: Important Money Management Tool for Forex Traders

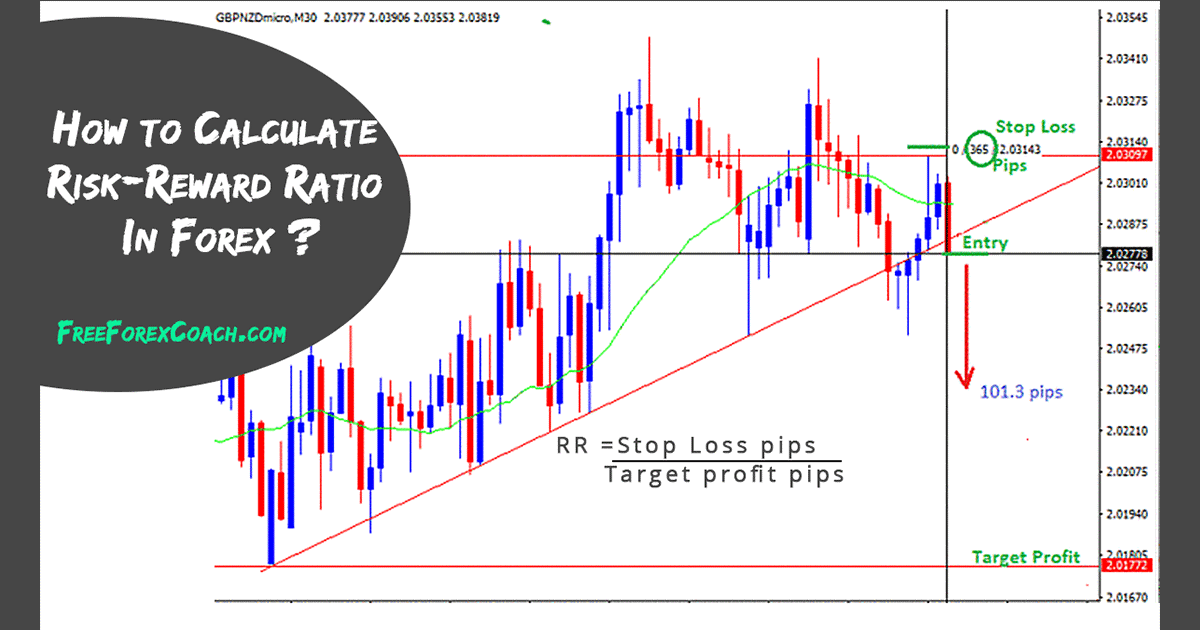

The Risk to Reward Ratio is one of the most critical aspects of risk management in Forex trading. Risk is the amount of money that a trader is willing to lose in a trade. Now, the Risk to Reward Ratio is simply the ratio between the size of your stop-loss to the size of your target profit. The larger the profit against the stop loss, the smaller the risk to reward ratio.

Which means your risk is a lot smaller than your reward. Typically, a minimum of or RRR is recommended for novice traders. There are super conservative traders where they look for a minimum RRR of The risk to reward in every trade cannot be fixed as it varies depending on the market condition.

For example, or RR ratio is achievable when the market is trending, and you enter the market at the right time. Whereas when the market is not very volatile, we should be happy with a risk to reward ratio of A trader can think of raising the target if the market moves to the initial take-profit quickly. This is because when the market moves so fast, it has the potential to move further, thereby increasing the profits, what does risk and reward ratio means in forex.

Another way to increase the risk to reward RR ratio is by taking the strong trade setups from the higher time frames like daily, weekly, and monthly. We need to wait for such strong trade setups to form. Once formed, the price will move for hundreds of pips, and so we can have wide targets.

Higher the RRR, the better it is, and of course, higher RRRs are more challenging to achieve. So, do not forget to keep the expectations real and the risks appropriate. You do not have to avoid perfect trades just what does risk and reward ratio means in forex the RRR is not as high as Make sure to do proper risk management before placing a trade. Never trade with a risk to reward ratio that is too less and try to maximize it as much as possible.

Save my name, email, and website in this browser for the next time I comment. About Us Advertise With Us Contact Us. Forex Academy. Home Advanced Forex Education Forex Risk Management Basics of Risk To Reward Ratio In Forex Trading. RELATED ARTICLES MORE FROM AUTHOR. Forex Lot Size: How to Limit Risk in Forex More Easily. Every Trader Should Know This About Money Management. What You Can Do Today to Control Your Trading What does risk and reward ratio means in forex. LEAVE A REPLY Cancel reply.

Please enter your comment! Please enter your name here. You have entered an incorrect email address! Popular Articles. Forex Chart Patterns Might Be an Illusion 4 September, How Important are Chart Patterns in Forex? Chart Patterns: The Head And Shoulders Pattern 16 January, Academy is a free news and research website, offering educational information to those who are interested in Forex trading.

EVEN MORE NEWS. Understanding the Economics of Cryptocurrencies 13 June, Trading Reversals Using Bullish Reversal Candlestick Patterns 12 June, Using Bollinger Bands to Time the Rectangle Pattern 11 June, POPULAR CATEGORY Forex Market Analysis Forex Brokers Forex Service Review Crypto Market Analysis Forex Signals Forex Cryptocurrencies Academy - ALL RIGHTS RESERVED.

The Risk to Reward Ratio Explained in One Minute: From Definition and \

, time: 1:36Basics of Risk To Reward Ratio In Forex Trading | Forex Academy

/risk-reward-diagram-on-a-blackboard-838938302-f3f9d63b07cb49dbb38af2f3627b7768.jpg)

14/04/ · Using a reward to risk ratio, means you need to get 9 pips. Right off the bat, the odds are against you because you have to pay the spread. If your broker offered a 2 pip spread on EUR/USD, you’ll have to gain 11 pips instead, forcing you to take a difficult reward to risk ratio 04/03/ · The risk-reward ratio or risk-return ratio in trading represents the expected return and risk of a given trade or trades based on entry position and close position. A good risk-reward ratio tends to be less than 1; that is, the return (reward) is greater than the blogger.comted Reading Time: 9 mins 04/07/ · What is Risk to Reward Ratio and How to Calculate it in Forex Trading. Risk reward is a simple concept, but how you deploy and use it in your trading can be as advanced as you like. At its most basic, risk reward is the formula for how much reward you stand to make for the amount you are risking. For example; if you risk 10 pips on a trade and you have a profit target of 30 pips, then your risk reward Estimated Reading Time: 5 mins

No comments:

Post a Comment